For free World-class Trauma Therapy click here: https://faithlifenow.weebly.com For free book summaries and one of my newest books click here: https://mylands.gumroad.com/

Thank you! Email: [email protected] Check out our original insurance website at https://cainsure.weebly.com and our other insurance enrollment website www.insurancehubby.com or here http://kimig.tripod.com/medicare for more enrollment opportunities. We accept donations on PayPal here: here: https://tinyurl.com/Paypaldonatecharity We have a professional opportunity for you to work in a billion-dollar industry with Freedom Equity Group, owed in part by Fidelity (a 40-billion-dollar company!) click here at Get started here: Kimmy.fegteam.com or here https://bit.ly/getstartedfeg24

Thank you! Email: [email protected] Check out our original insurance website at https://cainsure.weebly.com and our other insurance enrollment website www.insurancehubby.com or here http://kimig.tripod.com/medicare for more enrollment opportunities. We accept donations on PayPal here: here: https://tinyurl.com/Paypaldonatecharity We have a professional opportunity for you to work in a billion-dollar industry with Freedom Equity Group, owed in part by Fidelity (a 40-billion-dollar company!) click here at Get started here: Kimmy.fegteam.com or here https://bit.ly/getstartedfeg24

Pick up your free download on Amazon for the sample of the book "Dandelion Covid" by Bella Bellew! Dandelion prevents Covid!

Where You Come First!

You can shop different plans to get the right one at the right price!

You can shop different plans to get the right one at the right price!

Are you properly protected?

Original Medicare only pays for 80% of Medicare Approved Services. Twenty percent (20%) of a $50,000.00 hip surgery, heart attack or stroke is a big chunk of change.

Original Medicare only pays for 80% of Medicare Approved Services. Twenty percent (20%) of a $50,000.00 hip surgery, heart attack or stroke is a big chunk of change.

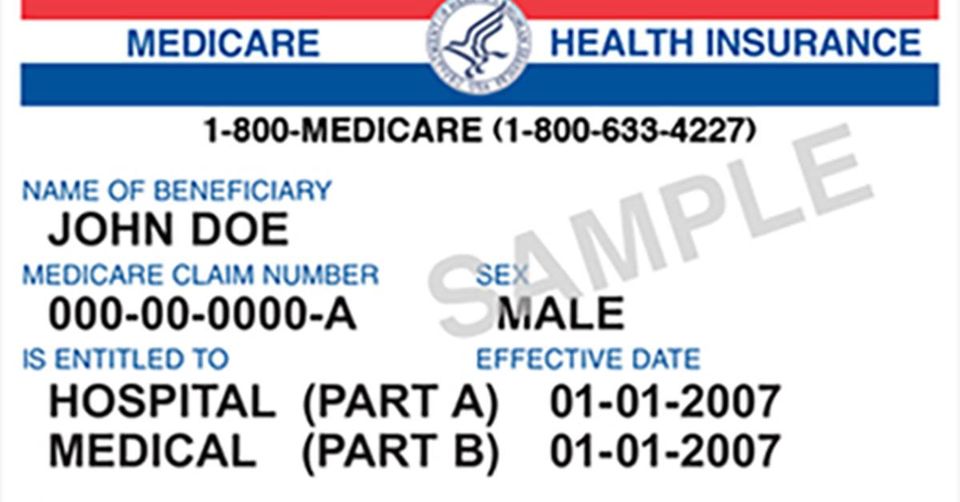

Self Enrolling Helps Protect Your Identity!

By Self Enrolling you protect your personal identity (example: your Medicare Number, Your social security number, birthdate...), your personal health information (example: diabetic, heart disease...) and because your information goes directly to the carrier only rather than an agent keeping it locked in a file cabinet for ten years (as the federal law requires insurance agents to do).

FOR INDIVIDUALS, FAMILIES & SMALL BUSINESSES (SEE BELOW):

For Affordable Care Act (Affordable Health care plans)

Get free quotes or self enroll here: http://bit.ly/HealthEnroll if you live in Texas, Ohio, New Mexico,

Oregon, Michigan, Florida, South Carolina, Virginia.

And get your free quotes or self enroll here if you live anywhere else https://bit.ly/ReferACA

(with the exception of CA, Nevada, Washington or any other state based health

insurance plans).

By Self Enrolling you protect your personal identity

(example: your Medicare Number, Your social security number, birthdate...),

your personal health information (example: diabetic, heart disease...)

and because your information goes directly to the carrier only

rather than an agent keeping it locked in a file cabinet

for ten years (as the federal law requires insurance agents to do).

You also protect your self from Covid & from Inclement weather.

Self Enroll or call 760-250-6222 to speak to a licensed agent

for assistance in self enrolling or to help you enroll. Thank you!

For Affordable Care Act (Affordable Health care plans)

Get free quotes or self enroll here: http://bit.ly/HealthEnroll if you live in Texas, Ohio, New Mexico,

Oregon, Michigan, Florida, South Carolina, Virginia.

And get your free quotes or self enroll here if you live anywhere else https://bit.ly/ReferACA

(with the exception of CA, Nevada, Washington or any other state based health

insurance plans).

By Self Enrolling you protect your personal identity

(example: your Medicare Number, Your social security number, birthdate...),

your personal health information (example: diabetic, heart disease...)

and because your information goes directly to the carrier only

rather than an agent keeping it locked in a file cabinet

for ten years (as the federal law requires insurance agents to do).

You also protect your self from Covid & from Inclement weather.

Self Enroll or call 760-250-6222 to speak to a licensed agent

for assistance in self enrolling or to help you enroll. Thank you!

Indexed Universal Life (IUL) Insurance & Annuities

We have a professional opportunity for you to work in a billion-dollar industry with Freedom Equity Group, owed in part by Fidelity (a 40-billion-dollar company!) click here at Get started here: Kimmy.fegteam.com or here https://bit.ly/getstartedfeg24

IUL's & Annuities Protect Your Money With Tax-FREE Market Gains with Guaranteed NO Risk & lower fees than a 401K or an IRA! Call 760-250-6222 or email: [email protected] to get your no cost, no obligation needs analysis & consultation.

IUL's & Annuities Protect Your Money With Tax-FREE Market Gains with Guaranteed NO Risk & lower fees than a 401K or an IRA! Call 760-250-6222 or email: [email protected] to get your no cost, no obligation needs analysis & consultation.

ARE YOU TURNING 65?

ARE YOU ON A GROUP HEALTH PLAN?

THIS IS EXTREMELY IMPORTANT!!

I want to help YOU SAVE A LOT OF MONEY and I want to help SPARE YOU from a lot of very potential regrets!!

I want to help people turning 65 (T65) because if you work for any company that has less than 20 employees you can go ahead and enroll in Medicare then you will only pay about half ( 1/2) as much for health insurance as you were paying for your Employee Group Health Major Medical plan.

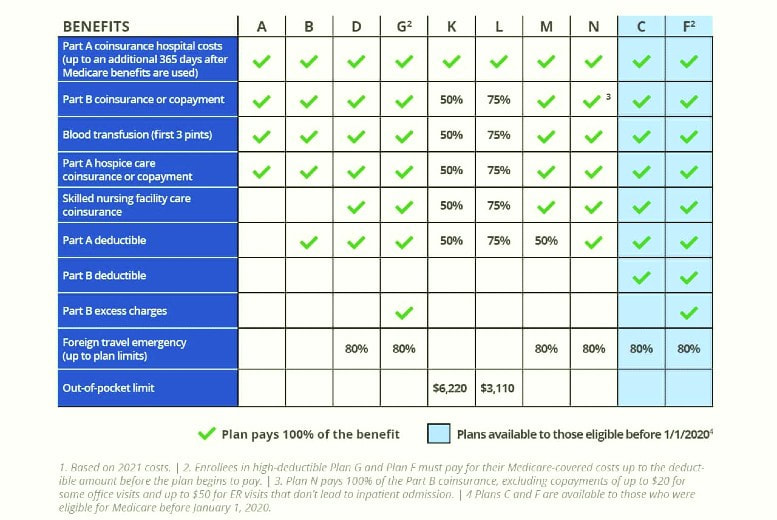

I can help you through the whole process and explain how you will be responsible for 20% of ALL your medical bills if you only have straight Medicare. And how Medicare Advantage (MA no RX or MAPD includes RX) plans are generally for people who want to pay little to nothing for premiums up front. They are the plans that are sometimes $0 and may come with a little dental, vision, hearing, RX or may not come with some or any of those. But Medicare Advantage Plans have more costs on the other side (back end) of the health plan with co-insurance, co-pays, deductibles, and so forth. And they are restricted to in network in most cases.

Generally, they won't allow you to see a doctor outside of the plans network. You must also continue to pay their Part A (if you didn't work 10 yrs or have 40 full quarters) & Part B premiums ($170.10 for 2023). The Medicare Advantage plans also typically get a lot of complaints because some bills may not be covered if the plan didn't approve it and you get stuck with large out of pocket expenses you didn't budget for.

On the other hand..... Medicare supplement plans roll out the red carpet for you, there are no networks, you can see any doctor in the United States to have your knee surgery or whatever as long as the doctor/clinic/hospital excepts Medicare. It also covers international travel. The plan premiums may be higher but with the "G" plan there is nothing else to pay for except their part B premium of $170.10 plus one (1) annual deductible (this year it is $234). The Medicare Supplements don't have a lot other out of pocket (OOP) expenses like the Medicare Advantage plan does. And they get the best of the best as far as medical care and treatment. You are spared the medical qualifications but only for one time during their initial enrollment period 3 months prior to them turning 65. This means you won't pay more for your premium due to age or health conditions that you will be rated for over 65 yrs persons do.

ARE YOU TURNING 65?

ARE YOU ON A GROUP HEALTH PLAN?

THIS IS EXTREMELY IMPORTANT!!

I want to help YOU SAVE A LOT OF MONEY and I want to help SPARE YOU from a lot of very potential regrets!!

I want to help people turning 65 (T65) because if you work for any company that has less than 20 employees you can go ahead and enroll in Medicare then you will only pay about half ( 1/2) as much for health insurance as you were paying for your Employee Group Health Major Medical plan.

I can help you through the whole process and explain how you will be responsible for 20% of ALL your medical bills if you only have straight Medicare. And how Medicare Advantage (MA no RX or MAPD includes RX) plans are generally for people who want to pay little to nothing for premiums up front. They are the plans that are sometimes $0 and may come with a little dental, vision, hearing, RX or may not come with some or any of those. But Medicare Advantage Plans have more costs on the other side (back end) of the health plan with co-insurance, co-pays, deductibles, and so forth. And they are restricted to in network in most cases.

Generally, they won't allow you to see a doctor outside of the plans network. You must also continue to pay their Part A (if you didn't work 10 yrs or have 40 full quarters) & Part B premiums ($170.10 for 2023). The Medicare Advantage plans also typically get a lot of complaints because some bills may not be covered if the plan didn't approve it and you get stuck with large out of pocket expenses you didn't budget for.

On the other hand..... Medicare supplement plans roll out the red carpet for you, there are no networks, you can see any doctor in the United States to have your knee surgery or whatever as long as the doctor/clinic/hospital excepts Medicare. It also covers international travel. The plan premiums may be higher but with the "G" plan there is nothing else to pay for except their part B premium of $170.10 plus one (1) annual deductible (this year it is $234). The Medicare Supplements don't have a lot other out of pocket (OOP) expenses like the Medicare Advantage plan does. And they get the best of the best as far as medical care and treatment. You are spared the medical qualifications but only for one time during their initial enrollment period 3 months prior to them turning 65. This means you won't pay more for your premium due to age or health conditions that you will be rated for over 65 yrs persons do.

Otherwise... if you've past your 65 birthday you may have to pass thru underwriting. There is no underwriting for Medicare Advantage plans however, you may qualify for special plans if your health qualifies you for extra Medical care. This is real important because you do not have to pass thru underwriting to get a Medicare Supplement if and only if you're turning 65. It's easy to get on a Medicare Advantage plan after 65. Not so easy to get a Medicare Supplements (the Cadillac plan as some professionals call it) after you've turned 65 yrs of age.

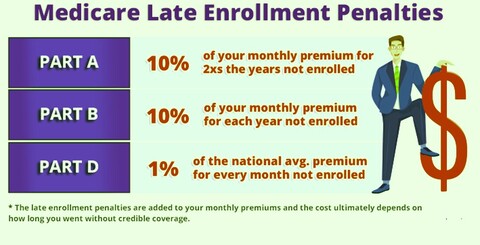

And if you don't have a qualified group health coverage and prescription drug coverage when you turn 65, you will also incur 2 separate penalties billed monthly for your entire life: 1st the Part B penalty which is the greatest penalty (10% of the part B premium and this year it's $170 and it goes up every year) 2nd you will receive a Part D penalty it is a little smaller but my friend had to pay $35 a month Part D penalty and that was after I pleaded and filed several grievances. And he only didn't enroll in the part D part for prescription drugs. Don't let this happen to you or your loved ones.

And if you don't have a qualified group health coverage and prescription drug coverage when you turn 65, you will also incur 2 separate penalties billed monthly for your entire life: 1st the Part B penalty which is the greatest penalty (10% of the part B premium and this year it's $170 and it goes up every year) 2nd you will receive a Part D penalty it is a little smaller but my friend had to pay $35 a month Part D penalty and that was after I pleaded and filed several grievances. And he only didn't enroll in the part D part for prescription drugs. Don't let this happen to you or your loved ones.

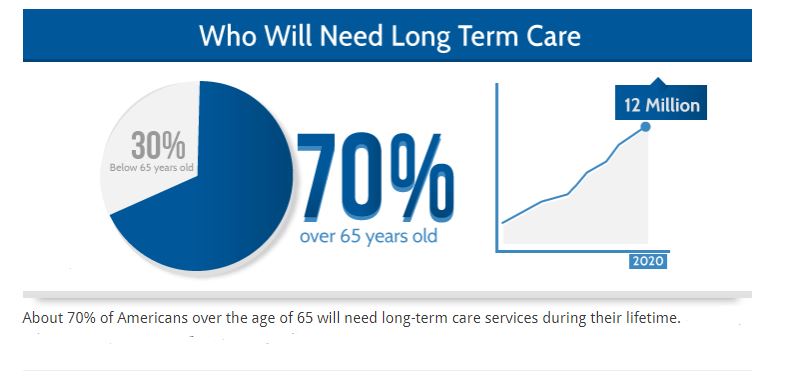

Everyone Needs Long Term Care Protection

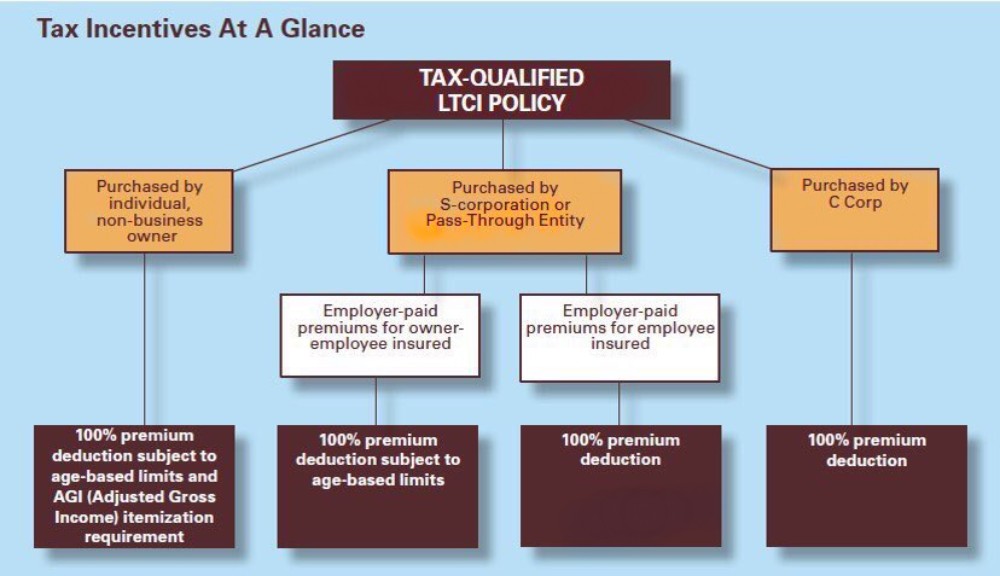

The question is; Do you want a Qualified Long Term Care Or Non Qualified Long Term Care? It's easier to trigger a non qualified benefit than to trigger a qualified benefit. Qualified Long Term Care Services may qualify for some Health Insurance costs tax benefits.

Long Term Care Is Not Covered By Medicare or Medicare Supplements

Long term care is not covered by Medicare or Medicare Supplements ( Medicare Only Pays for very little coverage only. The health care industry costs have risen double digit inflationary rates since the 1900s. With long term care national expenditure being the fastest growing element of health care cost. The average cost of an annual nursing home stay is $100,000 for a semi-private room. In Alaska a private room in a nursing home is $300,000 per year. Seventy five (75%) percent of elderly cannot even afford to pay for one year in a nursing home. Medicare doesn't pay for any Intermediate or custodial care services. Medicare only pays for the first 20 days after they have a 3 day hospital stay only. Then the insured pays the copay days 21-100. Medicare pays NOTHING after day 100. Some standardized Medicare Supplement plans pays ONLY for the copay days 21-90 at a Skilled Nursing Facility but only if it's a Medicare Approved facility and if they they were admitted followed by a 3 day stay at a hospital. Medicare Advantage plans do not pay for any Long Term Care. Generally speaking the benefits will have 10-100 day elimination period, 3-5 years of benefits or longer, Benefits triggered by impairment to activities of daily living, Benefits for skilled, intermediate, custodial, and home health care. Life insurance riders may also include adult daycare, cost of living protection, hospice, and other types of care. The Long term care policies may be integrated (Accelerated Death Benefits sometimes referred to as "Living Benefits") with benefits (this means the use of the Long Term Care benefits are deducted from the death benefit.

Chronic Illness rider pays 70 to 80% of death or annuity benefit to pay off nursing home expenses, or the Terminal illness rider which pays 90 to 95% of the death or annuity benefit to pay the nursing home expenses. Or they may be independent meaning they do not take away from the death benefit. Long term care policies may also be included or obtained through Group policies. Policies may be "Reimbursement" policies or "Expensed incurred Basis" that pay somewhere between 50% to 90% of the nursing home expenses. The rest are paid by the insured and the term used here for that is called "coinsurance". Plans can also be paid on an "Indemnity" basis. Usually the "Indemnity Cash policy" pays cash daily and could be around $200 a day even if the nursing home only charges $150, the policy will pay $200 cash daily to the insured. The "Indemnity Per Diem" pays on a daily basis also but if the nursing home charges $150 a day, then the plan will pay $150 per day. Plans may have "Inflation protection, Waiver of Premium or have an Elimination Period, Benefit period, Restoration of benefits, Home modification or other ancillary benefits, Survivor Benefits, Return of Premium (usually pays 60% to 80% of total premiums paid if policy is lapsed or surrendered, or a "Nonforfeiture option" Click here to see more details: https://www.medicare.gov/coverage/long-term-care-hospital-services Or here: https://www.aging.ca.gov/download.ashx?lE0rcNUV0zb5HC7UVQpEPQ%3D%3Dwww.aging.ca.gov/download.ashx?lE0rcNUV0zb5HC7UVQpEPQ%3D%3D

Free counseling is available at HICAP (Health Insurance Counseling And Advocacy) to help answer any questions regarding Health Insurance at 800-434-0222

There are stand alone Long term Care policies, Life insurance and annuity riders with long term care policies attached to the life insurance or annuity policies, there are also new hybrid policies that are for people who don't know if they will need or utilize the long term care benefits and in the event they don't use the long term care benefits then the payout would go towards the death benefit.

If you would like to see if you qualify text or call 760-250-6222 or email me at [email protected] to speak to a licensed agent.

Chronic Illness rider pays 70 to 80% of death or annuity benefit to pay off nursing home expenses, or the Terminal illness rider which pays 90 to 95% of the death or annuity benefit to pay the nursing home expenses. Or they may be independent meaning they do not take away from the death benefit. Long term care policies may also be included or obtained through Group policies. Policies may be "Reimbursement" policies or "Expensed incurred Basis" that pay somewhere between 50% to 90% of the nursing home expenses. The rest are paid by the insured and the term used here for that is called "coinsurance". Plans can also be paid on an "Indemnity" basis. Usually the "Indemnity Cash policy" pays cash daily and could be around $200 a day even if the nursing home only charges $150, the policy will pay $200 cash daily to the insured. The "Indemnity Per Diem" pays on a daily basis also but if the nursing home charges $150 a day, then the plan will pay $150 per day. Plans may have "Inflation protection, Waiver of Premium or have an Elimination Period, Benefit period, Restoration of benefits, Home modification or other ancillary benefits, Survivor Benefits, Return of Premium (usually pays 60% to 80% of total premiums paid if policy is lapsed or surrendered, or a "Nonforfeiture option" Click here to see more details: https://www.medicare.gov/coverage/long-term-care-hospital-services Or here: https://www.aging.ca.gov/download.ashx?lE0rcNUV0zb5HC7UVQpEPQ%3D%3Dwww.aging.ca.gov/download.ashx?lE0rcNUV0zb5HC7UVQpEPQ%3D%3D

Free counseling is available at HICAP (Health Insurance Counseling And Advocacy) to help answer any questions regarding Health Insurance at 800-434-0222

There are stand alone Long term Care policies, Life insurance and annuity riders with long term care policies attached to the life insurance or annuity policies, there are also new hybrid policies that are for people who don't know if they will need or utilize the long term care benefits and in the event they don't use the long term care benefits then the payout would go towards the death benefit.

If you would like to see if you qualify text or call 760-250-6222 or email me at [email protected] to speak to a licensed agent.

VOLUNTARY BENEFITS

Saves business owners money even without any contributions!

Information Brings Power!

Fact: It takes 3 employees to qualify, but only 1 needs to sign up

Fact: Employers save about as much as the employee spends on voluntary benefits ie: if employee spends $50 on Voluntary Benefits the employer will save about $50

Fact: Both Employee and Employer save $7.65 per benefit dollar spent on Voluntary Benefits

Fact: Voluntary Benefits compliment major medical insurance by providing cash for out of pocket medical expenses like co-pays, deductibles, out of pocket eligible medical expenses

Fact: 87% of all persons with major medical insurance coverage filed bankruptcy.

Fact: 62.1% of all bankruptcies are due to medical bills even with major medical coverage.

Fact: Voluntary Benefits have no deductibles

Fact: Voluntary Benefits pays to the policy holder or designated beneficiary

Fact: Voluntary Benefits can cost as little as a Happy Meal per week

Fact: Voluntary Benefits boost employee morale

Fact: Voluntary Benefits help recruit and retain employees

Fact: Employers generally save as much (through section 125) as the employees spend on Voluntary Benefits. Both employer and employee save roughly about 7.68 cents per benefit tax dollar spent.

Fact: Disability Insurance and/or Accident Insurance Covers Employees' accidents that happen on and/or off the job

Fact: Disability Insurance and/or Accident Insurance Pays directly to the insured

Fact: Accident Coverage may help minimize employer's workers' comp rate too because it covers employees' accidents that happen off job.

Fact: About 56% of Americans don't have $1000 savings to cover an unexpected bill. This survey was conducted by phone in January 2022 by Bank Rate.

Fact: We are the largest enrolling company in the nation and we don't charge employers to use our service

Fact: We love helping employers and employees save money, please let us know if you have other businesses in mind that can use our services

So as you see, it's a WIN-WIN for all!

If your ready to get started, you may text me at 760-250-6222 or email [email protected] to meet with myself or Will and he can be reached at 760-424-2416 and his email is [email protected] or one of our team members at your convenience.

We will follow up with you in a few days.

Reply YES to fax 760-405-4025 to get started. Or contact Will or Kimmy at the contact information provided above. You may also give this to the decision maker for voluntary benefits or to human Resources. Thank you!

Kimmy Darlene Gerred and All Valley Benefits, a Colonial Life Agency

#employbenefits #employeebenefits #groupbenefits #section125 #savemoney #businessowners

Saves business owners money even without any contributions!

Information Brings Power!

Fact: It takes 3 employees to qualify, but only 1 needs to sign up

Fact: Employers save about as much as the employee spends on voluntary benefits ie: if employee spends $50 on Voluntary Benefits the employer will save about $50

Fact: Both Employee and Employer save $7.65 per benefit dollar spent on Voluntary Benefits

Fact: Voluntary Benefits compliment major medical insurance by providing cash for out of pocket medical expenses like co-pays, deductibles, out of pocket eligible medical expenses

Fact: 87% of all persons with major medical insurance coverage filed bankruptcy.

Fact: 62.1% of all bankruptcies are due to medical bills even with major medical coverage.

Fact: Voluntary Benefits have no deductibles

Fact: Voluntary Benefits pays to the policy holder or designated beneficiary

Fact: Voluntary Benefits can cost as little as a Happy Meal per week

Fact: Voluntary Benefits boost employee morale

Fact: Voluntary Benefits help recruit and retain employees

Fact: Employers generally save as much (through section 125) as the employees spend on Voluntary Benefits. Both employer and employee save roughly about 7.68 cents per benefit tax dollar spent.

Fact: Disability Insurance and/or Accident Insurance Covers Employees' accidents that happen on and/or off the job

Fact: Disability Insurance and/or Accident Insurance Pays directly to the insured

Fact: Accident Coverage may help minimize employer's workers' comp rate too because it covers employees' accidents that happen off job.

Fact: About 56% of Americans don't have $1000 savings to cover an unexpected bill. This survey was conducted by phone in January 2022 by Bank Rate.

Fact: We are the largest enrolling company in the nation and we don't charge employers to use our service

Fact: We love helping employers and employees save money, please let us know if you have other businesses in mind that can use our services

So as you see, it's a WIN-WIN for all!

If your ready to get started, you may text me at 760-250-6222 or email [email protected] to meet with myself or Will and he can be reached at 760-424-2416 and his email is [email protected] or one of our team members at your convenience.

We will follow up with you in a few days.

Reply YES to fax 760-405-4025 to get started. Or contact Will or Kimmy at the contact information provided above. You may also give this to the decision maker for voluntary benefits or to human Resources. Thank you!

Kimmy Darlene Gerred and All Valley Benefits, a Colonial Life Agency

#employbenefits #employeebenefits #groupbenefits #section125 #savemoney #businessowners

UNDER 65 Affordable Care Act (ACA) Health Insurance Plans (Most people qualify for $0-$10 plans depending on their tax credit)

For Under 65 Affordable Care Act (Obamacare) ACA plans in Texas, Ohio, New Mexico, Oregon, Michigan, Florida, South Carolina, Virginia Click the button below that says "SELF ENROLL FOR OBAMACARE HEALTHCARE PLANS (ACA PLANS) Generally, you may enroll between Nov. 1 and December 15th.

IMPORTANT 2022 HEALTH & MEDICARE PLANS Information! Self Enrolling Helps Protect You From Covid & From ID Theft.

For Affordable Care Act (Affordable Health care plans) Shop here https://bit.ly/ReferACA if you live in Texas, Ohio, New Mexico, Oregon, Michigan, Florida, South Carolina, Virginia. And shop here if you live anywhere else https://bit.ly/HealthEnroll (with the exception of CA, Nevada, Washington or any other state based health insurance plans) If you've received 1 week or more of unemployment benefits, I can get you in a $0 premium Silver plan in Marketplace. In general, there are rate decreases for individuals for about $50-$70 per person since May 2021 on the health care marketplace exchange insurance plans. Many business owners are switching to the market place plans because it gives their employees more coverage at a better rate.

For Affordable Care Act (Affordable Health care plans) Shop here https://bit.ly/ReferACA if you live in Texas, Ohio, New Mexico, Oregon, Michigan, Florida, South Carolina, Virginia. And shop here if you live anywhere else https://bit.ly/HealthEnroll (with the exception of CA, Nevada, Washington or any other state based health insurance plans) If you've received 1 week or more of unemployment benefits, I can get you in a $0 premium Silver plan in Marketplace. In general, there are rate decreases for individuals for about $50-$70 per person since May 2021 on the health care marketplace exchange insurance plans. Many business owners are switching to the market place plans because it gives their employees more coverage at a better rate.

Are you new to Medicare? If you have just straight Medicare you have 80% coverage on most hospital and medical procedures, but you're still responsible for the other 20% of the bill. Twenty percent of a broken hip from a fall could put some in financial devastation. What about 20% of a heart attack? We're talking big bucks that have caused a lot of financial issues for those without extra coverage. Even with a Medicare Advantage plan, you're still at risk for max out of pocket costs unless you have a hospital indemnity plan with it. But there's the Medicare Supplement plan that someone turning 65 can get without having to go thru health underwriting questions to qualify for. These plans typically have higher premiums, but you are covered to go to any Medical Provider anywhere in the U.S. A (as long a they accept Medicare) without having to have a referral. Then there's very little you would have to pay on the back end for medical procedures. The good news for some is that if you've already passed the turning 65 mark, or if you have serious health conditions already that may cause your Medicare Supplement application to be denied once submitted to underwriting, there's still the other option of a Medicare Advantage plan. All you need to do is add an Indemnity plan with it then you will remove most of the big out of pocket risks for such things as a broken hip or heart attack that may require a long hospital stay. I offer both Medicare Supplements and Medicare Advantage plans as well as Stand alone prescription drug plans, dental, vision and hearing plans and I can bundle some of them up or sell them individually depending on what will work best for your individual scenario of lifestyle & budget.

For Medicare Supplements: Click here to enroll in an Anthem Medicare Supplement or here http://bit.ly/CAMedSups or to enroll in a Mutual of Omaha Medicare supplement click here: https://bit.ly/medsup21 . There are also lots of other Medicare Supplement Plans & carriers listed below.

For Medicare Supplements: Click here to enroll in an Anthem Medicare Supplement or here http://bit.ly/CAMedSups or to enroll in a Mutual of Omaha Medicare supplement click here: https://bit.ly/medsup21 . There are also lots of other Medicare Supplement Plans & carriers listed below.

Scroll down to see many other National Carriers like Anthem, Humana, Blue Shield, Mutual Of Omaha, Aetna and others. If there's a carrier your interested in but don't see it, call 760-250-6222 and they will direct you to the right location on this page. Some carriers on this page are in the tab's at the top. Thank you!

Straight Medicare: potentially substantial exposure to high medical bills

Medicare Advantage: potential exposure to high medical bills. Medicare Advantage plans also come with a built in "MAX OUT OF POCKET" which help protect against high medical bills. But you MUST check the amount because each plan varies. You may ask your insurance agent if there are any good Indemnity plans that you can add to help reduce some of the risk.

Medicare Supplement plan "G": substantially reduces exposure to high medical bills, but you still may be required to pay your annual part B deductible of $233 for plan year 2022 (amount of part B deductible changes every year).

For Plan year 2022 the standard premiums and deductibles are as follows:

Part A Premium is free if you've worked for ten years or have 40 quarters. It's $274 for 30-39 quarters. Less than 30 quarters is $499 monthly premium.

The Part A deductible of $1,556 is for each benefit period not an annual deductible, so you could have multiple Part A deductibles in one year. It's for each hospital stay. Also, $389 coinsurance per day of each benefits period Days 91 and beyond. $778 coinsurance per each lifetime reserve day after day 90 for each benefit period (up to 60 days total over your lifetime.) Beyond lifetime reserve days: you pay all costs.

The Part B Premium is $170.00 monthly for plan year 2022.

For Part B deductible you pay $233.00 annually for plan year 2022.

This is where the potential for risk exposure for mountain high medical bills begins. Also why most pick a Medicare Supplement "G" plan because it pays for everything except the Part B $233.00 annual deductible for plan year 2022.

The Part D (Prescription Drugs) standard deductible is $480 for plan year 2022.

There's a magic time in one's life when we get the green "GO" sign without having to answer medical questions to purchase health insurance of Medicare supplements (some have referred to as the "Cadillac plan"). The Medicare Supplement plans are generally higher cost up front (premium) then on the backside (deductibles and co insurance). Medicare Advantage plans are a lot more out of pocket cost risks on the back end. Some have referred to the Medicare Advantage plan as the economy car if Medicare supplements (medigap or med sup) are the Cadillac plans. I can look to see what other options (part B premium returns or insulin savings plans) are in your area. To speak to a licensed agent call the office: 760-808-8098 or mobile: 760-250-6222. Thank you!

Click here to enroll in an Anthem Medicare Supplement or here http://bit.ly/CAMedSups or to enroll in a Mutual of Omaha Medicare supplement click here: https://bit.ly/medsup21 . There are also lots of other Medicare Supplement Plans & carriers listed below.

Click here to enroll in an Anthem Medicare Supplement or here http://bit.ly/CAMedSups or to enroll in a Mutual of Omaha Medicare supplement click here: https://bit.ly/medsup21 . There are also lots of other Medicare Supplement Plans & carriers listed below.

Kimmy Gerred Insurance Services offering multiple carriers, free quotes & apply in multiple states at www.medicareinstantquote.com

You may change plans as many times as you want during the Annual Enrollment Period which is October 15 - December 7. During this time, you can change your Medicare insurance plan for a new plan that will be effective January 1, 2021.

If you are unhappy with the plan you choose, the Disenrollment period is Jan - March 31st, 2021 at which time you may join another "like" plan or return to original Medicare.

5 Star Enrollment Period

There's also a 5 Star Enrollment period at which time you may be able to enroll in a 5 Star plan. "If a Medicare Advantage Plan, Medicare drug plan, or Medicare Cost Plan with a 5-star rating is available in your area, you can use the 5-star Special Enrollment Period to switch from your current Medicare plan to a Medicare plan with a “5-star” quality rating. You can use this Special Enrollment Period only once between December 8 and November 30."

Part B Premium Return

Make sure to look for the newest benefits in the plan you want. Some Medicare Advantage plans are now offering Part B premium Return and/or Insulin Savings. Just make sure that the Max out of pocket is not too much more significant than all the other plans and that all of your doctors, hospitals, pharmacies are in network if the plan requires. More importantly, make sure that it also provides the Part D drug coverage if you need that. And that your prescriptions are covered at the tier level and copays that are a good fit for your needs. Thank you for shopping with us! Stay safe & healthy! Note You must continue to pay your part B premium. But if you get extra help to cover your premiums you may not qualify for the part b premium return. In other words, some may not qualify for the Part B Premium return if they are on a plan that the state helps them with their premiums, co-insurance or copayments. Thank you!

You may change plans as many times as you want during the Annual Enrollment Period which is October 15 - December 7. During this time, you can change your Medicare insurance plan for a new plan that will be effective January 1, 2021.

If you are unhappy with the plan you choose, the Disenrollment period is Jan - March 31st, 2021 at which time you may join another "like" plan or return to original Medicare.

5 Star Enrollment Period

There's also a 5 Star Enrollment period at which time you may be able to enroll in a 5 Star plan. "If a Medicare Advantage Plan, Medicare drug plan, or Medicare Cost Plan with a 5-star rating is available in your area, you can use the 5-star Special Enrollment Period to switch from your current Medicare plan to a Medicare plan with a “5-star” quality rating. You can use this Special Enrollment Period only once between December 8 and November 30."

Part B Premium Return

Make sure to look for the newest benefits in the plan you want. Some Medicare Advantage plans are now offering Part B premium Return and/or Insulin Savings. Just make sure that the Max out of pocket is not too much more significant than all the other plans and that all of your doctors, hospitals, pharmacies are in network if the plan requires. More importantly, make sure that it also provides the Part D drug coverage if you need that. And that your prescriptions are covered at the tier level and copays that are a good fit for your needs. Thank you for shopping with us! Stay safe & healthy! Note You must continue to pay your part B premium. But if you get extra help to cover your premiums you may not qualify for the part b premium return. In other words, some may not qualify for the Part B Premium return if they are on a plan that the state helps them with their premiums, co-insurance or copayments. Thank you!

IMPORTANT 2022 HEALTH & MEDICARE PLANS Information

Self Enrolling Helps Protect You From Covid & From ID Theft!

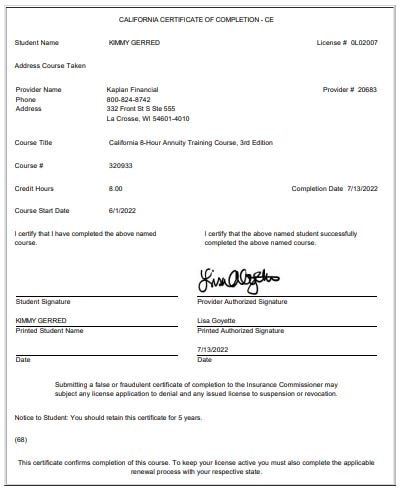

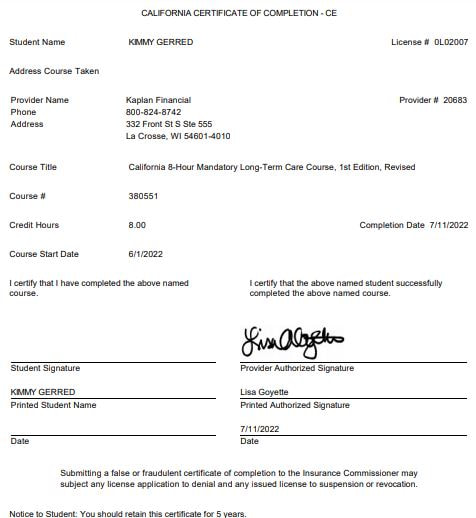

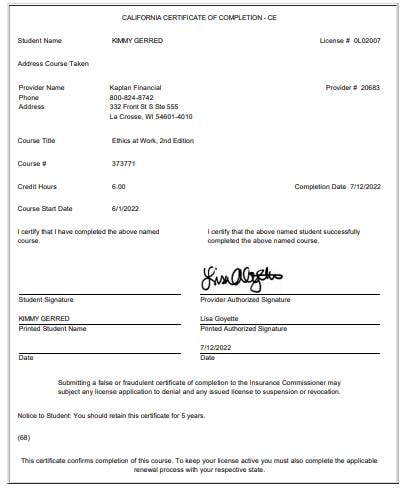

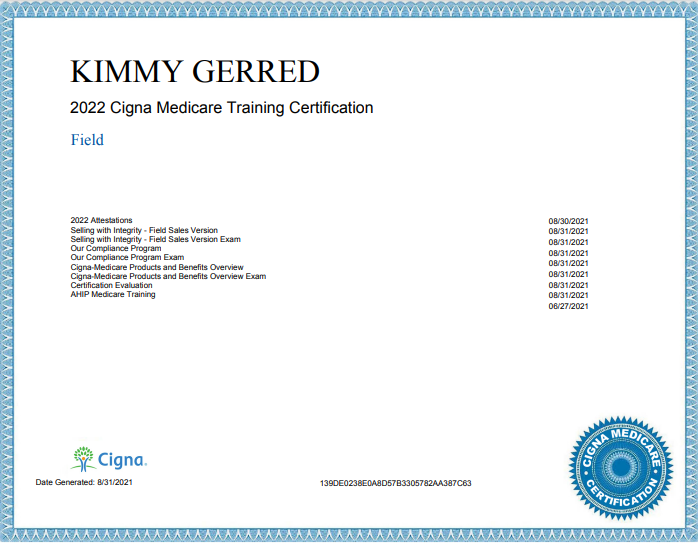

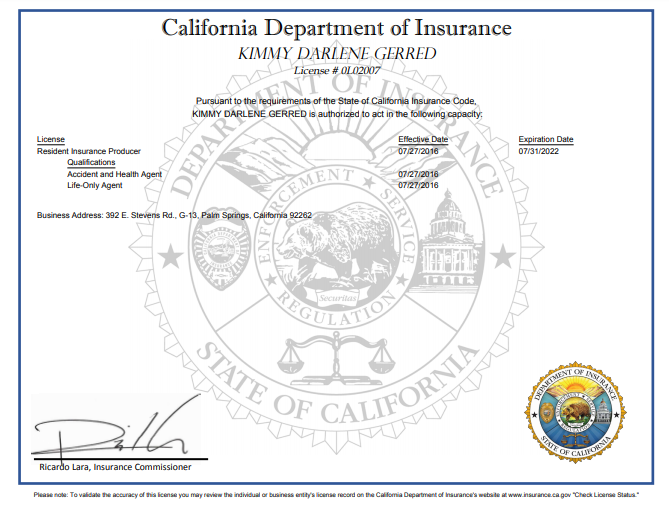

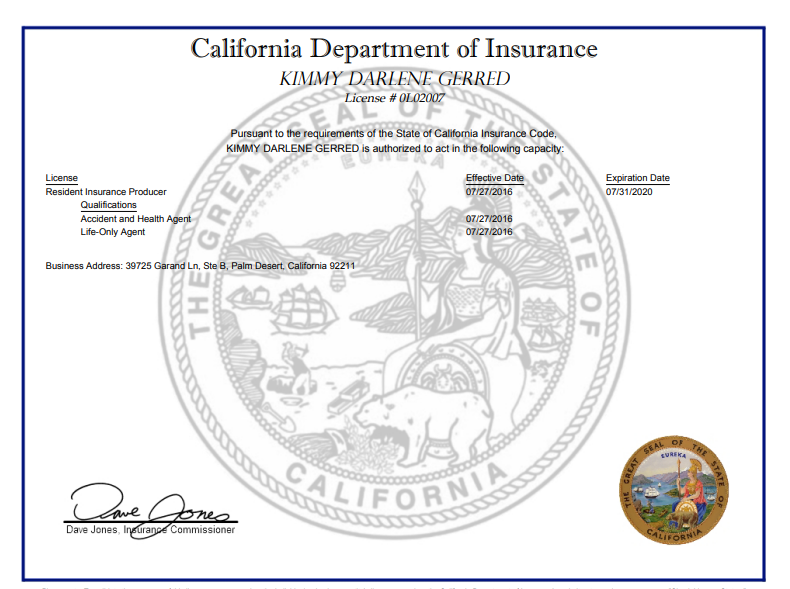

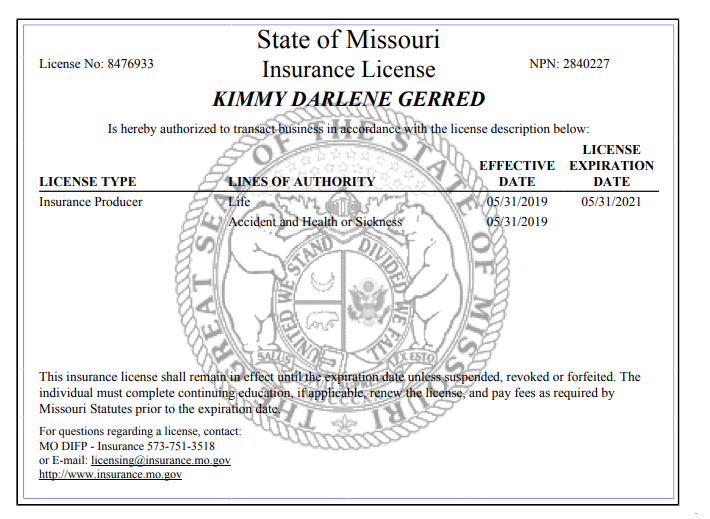

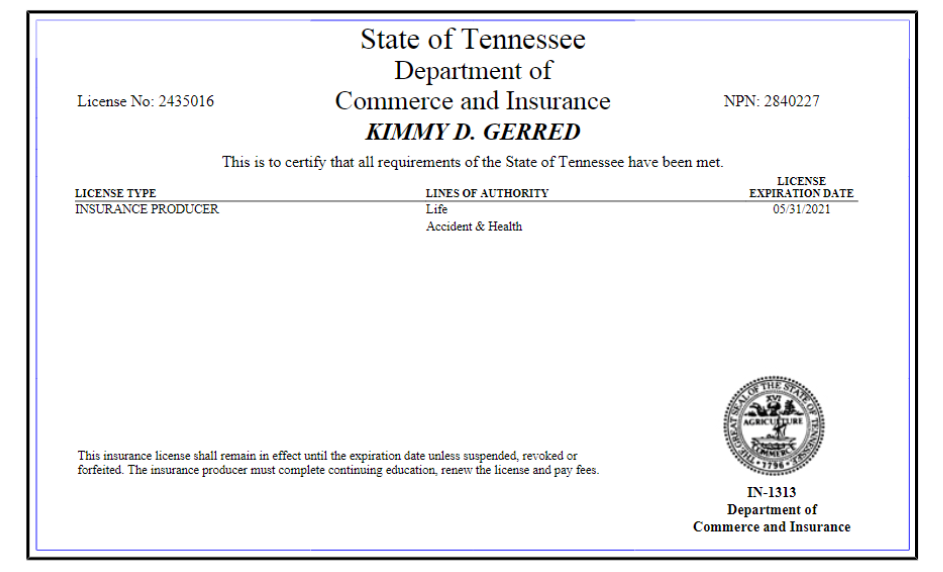

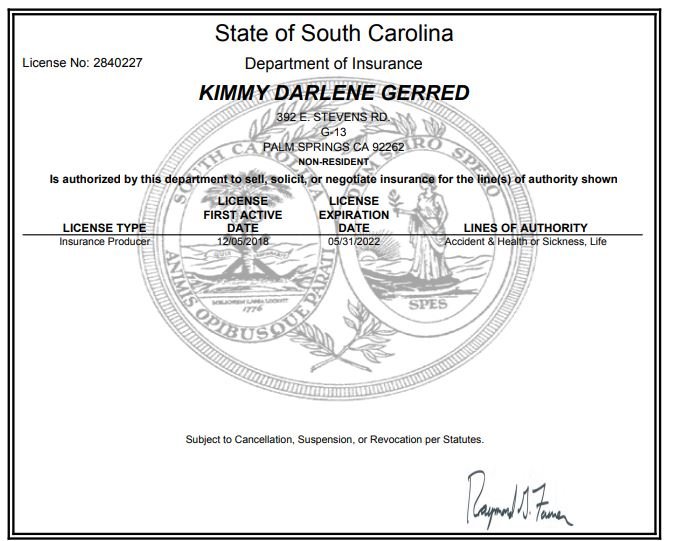

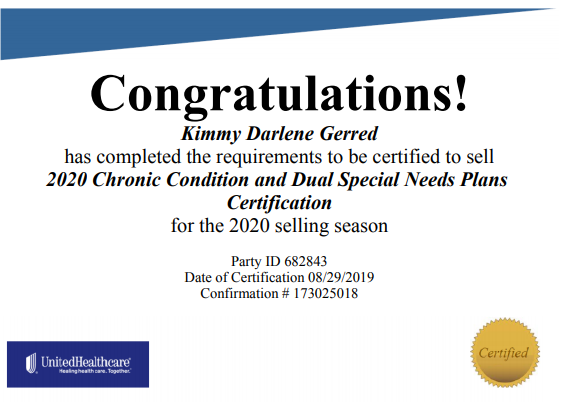

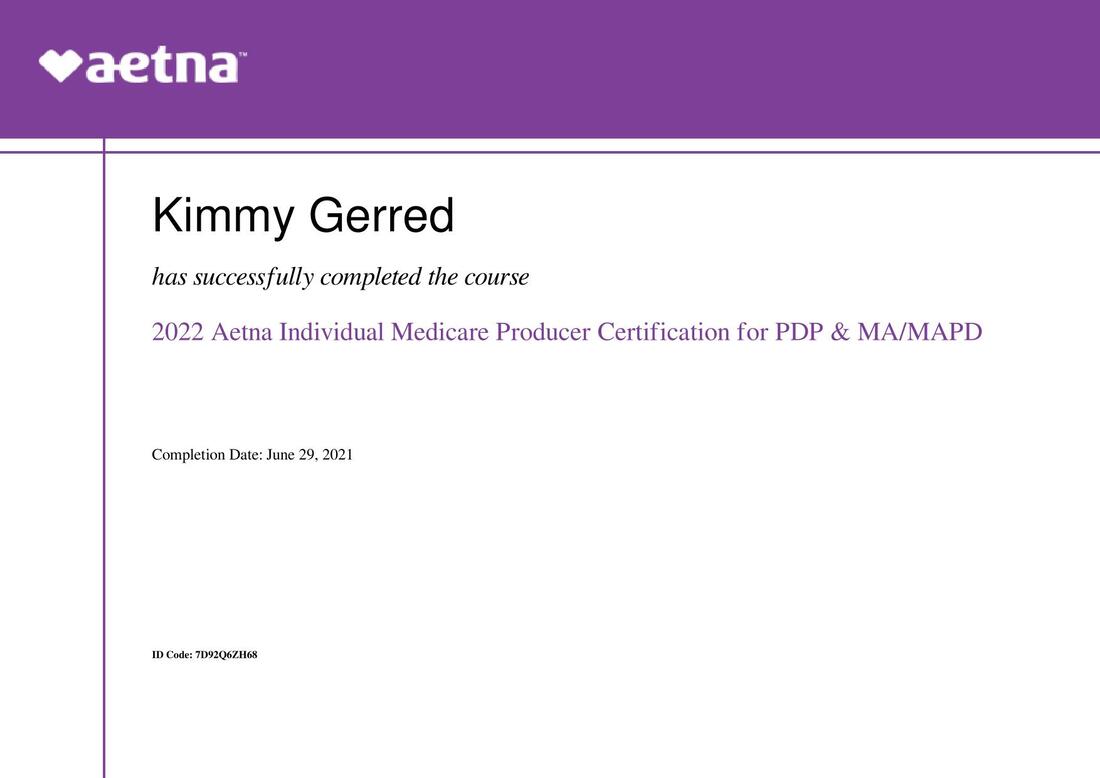

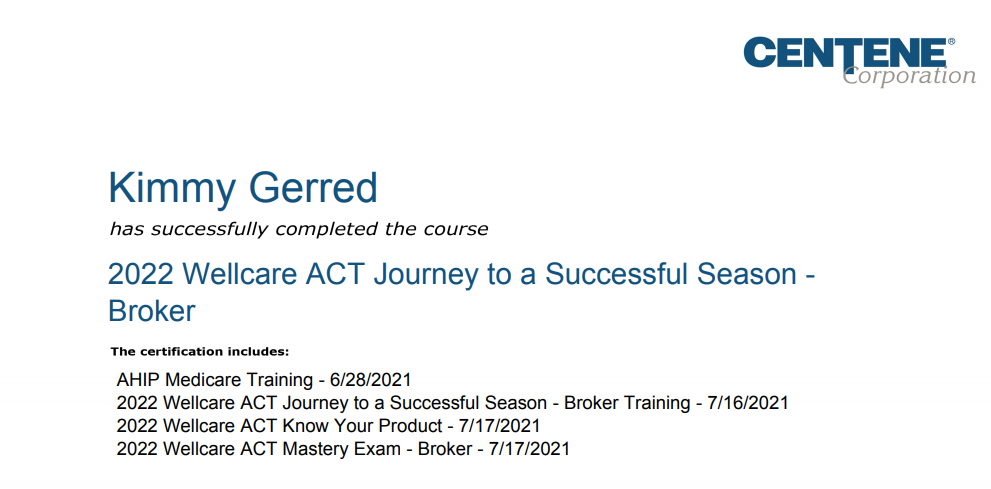

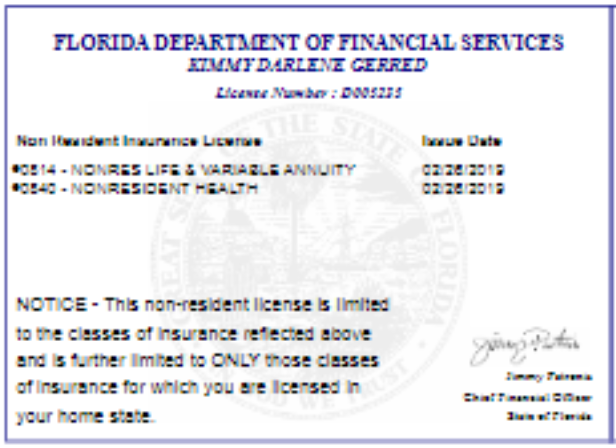

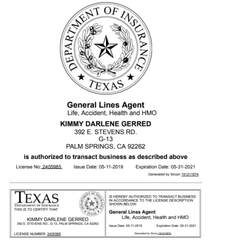

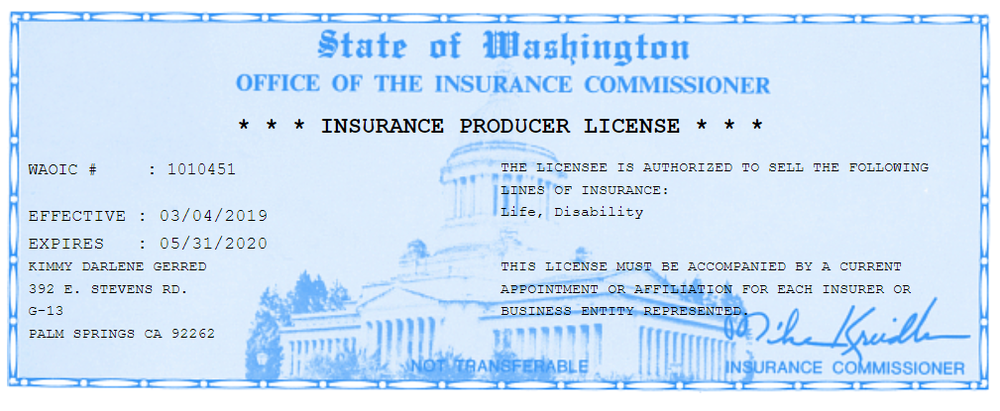

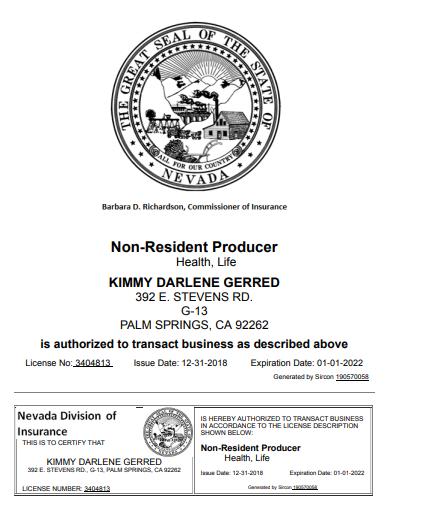

Licenses: CA: 0L02007 FL: D005235 MI: 2840227, NV: 3404813 OH: 1217370 SC: 2840227 TX: 2405985 OR: 2840227 NM: 2840227 VA: 1234697 WA: 1010451

FOR MEDICARE BENEFICIARIES SEE BELOW:

For Medicare Supplement Plans

(no networks, accepted whereever they accept Medicare)

see below:

Get your free quotes or selfenroll for Medicare Supplement here:

https://bit.ly/MedSuppNatGen

or here: https://bit.ly/MOOMEDSUPPLEMENT

For California Medicare Supplements

see below:

Get your free quotes or selfenroll for California Medicare Supplement Plan here: https://bit.ly/CaMedSup

For Medicare Advantage Plans

see below:

Shop & Self Enroll here for Medicare MA & MAPD health Plans https://bit.ly/medicarehealthplan

Make sure to check right plan year. Thank you!

For MAPD or MA Plan Here:

https://lnkd.in/gdPfj3ba

Dental & Vision free quotes or Self Enroll https://lnkd.in/g5fQTJSS

For Manhattan Life $3k Dental, 3k Vision, $3k Hearing Free quotes or Self Enroll: http://bit.ly/ManHatDental

For Delta Dental https://bit.ly/Dental4all

FOR INDIVIDUALS, FAMILIES & SMALL BUSINESSES (SEE BELOW):

For Affordable Care Act (Affordable Health care plans)

Get free quotes or self enroll here: http://bit.ly/HealthEnroll if you live in Texas, Ohio, New Mexico,

Oregon, Michigan, Florida, South Carolina, Virginia.

And get your free quotes or self enroll here if you live anywhere else https://bit.ly/ReferACA

(with the exception of CA, Nevada, Washington or any other state based health

insurance plans).

By Self Enrolling you protect your personal identity

(example: your Medicare Number, Your social security number, birthdate...),

your personal health information (example: diabetic, heart disease...)

and because your information goes directly to the carrier only

rather than an agent keeping it locked in a file cabinet

for ten years (as the federal law requires insurance agents to do).

You also protect your self from Covid & from Inclement weather.

Self Enroll or call 760-250-6222 to speak to a licensed agent

for assistance in self enrolling or to help you enroll. Thank you!

For the Free World-Class Trauma Therapy click here: https://bit.ly/FreeTraumaTherapy

Best Regards,Thank you! Kimmy Gerred

Self Enrolling Helps Protect You From Covid & From ID Theft!

Licenses: CA: 0L02007 FL: D005235 MI: 2840227, NV: 3404813 OH: 1217370 SC: 2840227 TX: 2405985 OR: 2840227 NM: 2840227 VA: 1234697 WA: 1010451

FOR MEDICARE BENEFICIARIES SEE BELOW:

For Medicare Supplement Plans

(no networks, accepted whereever they accept Medicare)

see below:

Get your free quotes or selfenroll for Medicare Supplement here:

https://bit.ly/MedSuppNatGen

or here: https://bit.ly/MOOMEDSUPPLEMENT

For California Medicare Supplements

see below:

Get your free quotes or selfenroll for California Medicare Supplement Plan here: https://bit.ly/CaMedSup

For Medicare Advantage Plans

see below:

Shop & Self Enroll here for Medicare MA & MAPD health Plans https://bit.ly/medicarehealthplan

Make sure to check right plan year. Thank you!

For MAPD or MA Plan Here:

https://lnkd.in/gdPfj3ba

Dental & Vision free quotes or Self Enroll https://lnkd.in/g5fQTJSS

For Manhattan Life $3k Dental, 3k Vision, $3k Hearing Free quotes or Self Enroll: http://bit.ly/ManHatDental

For Delta Dental https://bit.ly/Dental4all

FOR INDIVIDUALS, FAMILIES & SMALL BUSINESSES (SEE BELOW):

For Affordable Care Act (Affordable Health care plans)

Get free quotes or self enroll here: http://bit.ly/HealthEnroll if you live in Texas, Ohio, New Mexico,

Oregon, Michigan, Florida, South Carolina, Virginia.

And get your free quotes or self enroll here if you live anywhere else https://bit.ly/ReferACA

(with the exception of CA, Nevada, Washington or any other state based health

insurance plans).

By Self Enrolling you protect your personal identity

(example: your Medicare Number, Your social security number, birthdate...),

your personal health information (example: diabetic, heart disease...)

and because your information goes directly to the carrier only

rather than an agent keeping it locked in a file cabinet

for ten years (as the federal law requires insurance agents to do).

You also protect your self from Covid & from Inclement weather.

Self Enroll or call 760-250-6222 to speak to a licensed agent

for assistance in self enrolling or to help you enroll. Thank you!

For the Free World-Class Trauma Therapy click here: https://bit.ly/FreeTraumaTherapy

Best Regards,Thank you! Kimmy Gerred

Click here to enroll in an Anthem Medicare Supplement or here http://bit.ly/CAMedSups or to enroll in a Mutual of Omaha Medicare supplement click here: https://bit.ly/medsup21 . There are also lots of other Medicare Supplement Plans & carriers listed below.

Get Quotes From Plans Available In Your AreaAnthem Apply Online

Mutual Of Omaha Offers Medicare Supplement Insurance And they are in multiple states. They also offer Under 65 Health insurance plans too. They also offer Life Insurance.

Click to apply >>>>>> Do you Exercise 3+ hours per week. You can save on your life Insurance.

To Get a Quote for HUMANA Medicare Advantage Or PDP Call: 760-808-8098 for a LIVE Agent. They are in multiple states across the nation for Medicare Insurance Plans and For Under 65 Health Insurance plans including Dental and Vision for both Medicare Insurance Plans and Under 65 Health Insurance plans. Thank you!

Oscar has Medicare Supplement Insurance Plans for Individuals and for Small Group and will begin to offer Medicare Advantage Plans in New York and Texas in October 2019. Oscar is in the following states for Medicare Supplements: AZ., NJ., NY., TN., TX., OH., MI., MO., FL., CA.

, National General Offers Medicare Supplements and Under 65 Health Insurance. They have a super Hospital Indemnity plan too! They are in Most of the United States. They're one of my favorite carriers!

Central States Health & Life Co. of Omaha offers Medicare Supplement Insurance Plans and they are in the following states: AL., IA., ID., IL., KS., MI., MT., ND., NE., NV., OK., SD., TN., TX., VA., & WY. for your convenience.

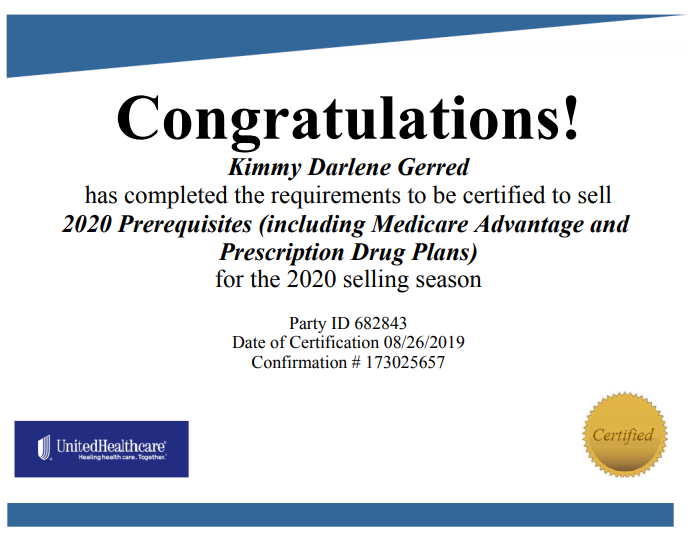

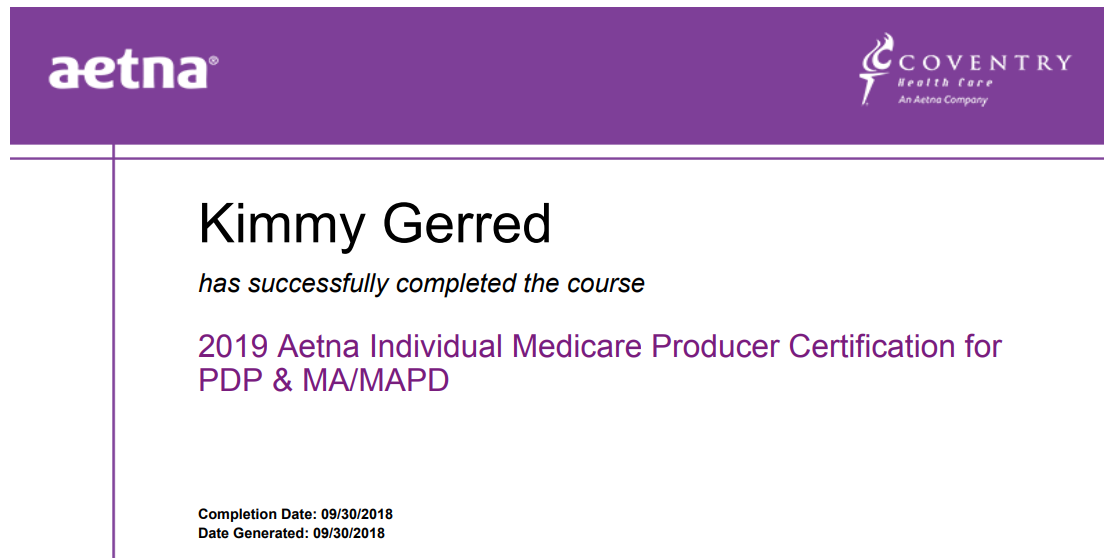

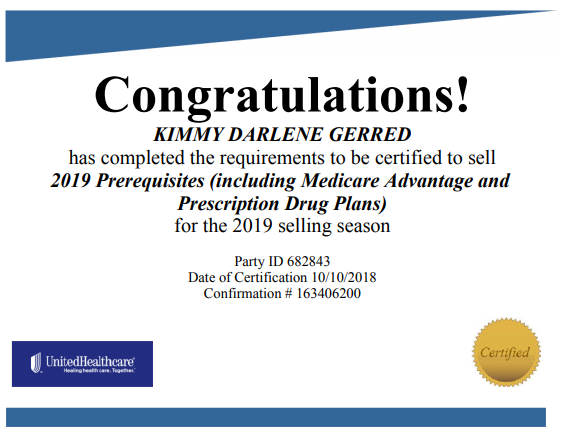

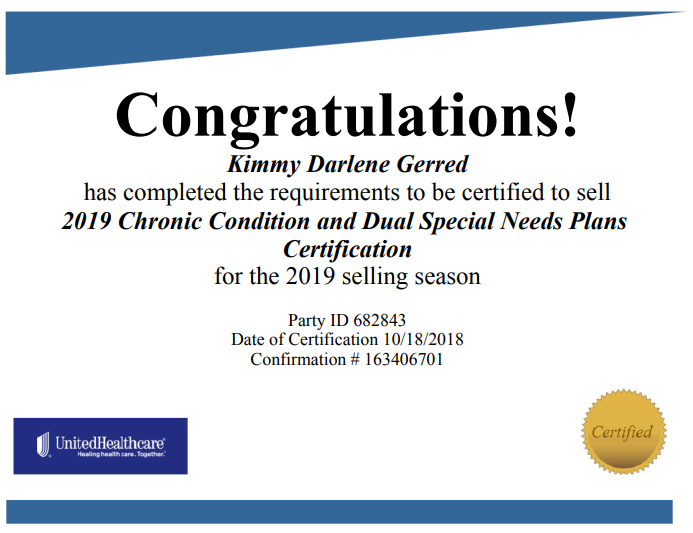

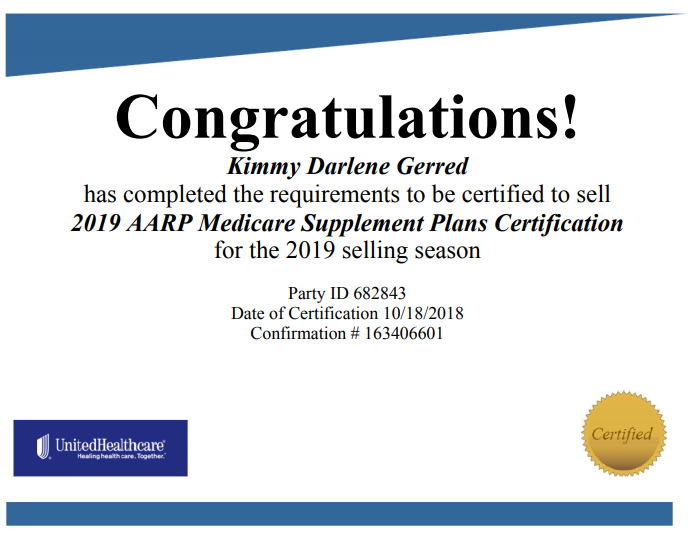

To Get a quote or to apply with United Healthcare Medicare Supplement Plans And Medicare Advantage Plans Please call 760-808-8098. Or 760-250-6222. Thank you!

Union Security Offers Medicare Supplement Insurance Plans and are in the following states: AL., CO., DE., FL., IA., IL., IN., KS., KY., LA., MD., MI., MS., MT., NC., ND., NE., NJ., NM., NV., OH., OK., PA., SC., SD., TX., UT., VA., WI.. and WV. Please call 760-808-8098 for a quote or to apply. Thank you!

|

Health Net: Apply Now Online Click Below (Offering Both Medicare Advantage & Medicare Supplement Insurance)

For Manhattan Life $3000 Dental, $3000 Vision, $3000 Hearing Click here: http://bit.ly/ManHatDental

Kaiser Permanent is located in the following states: California - Georgia, Washington, Oregon, Virginia, Maryland, Washington DC, and Colorado

To get a quote or to apply for Union Security Insurance Company please call 760-808-8098 for a live agent.

Or to apply for Kaiser Permanente Offers Medicare Supplement Plans and Under 65 Health Insurance for CALIFORNIA Click Here: KAISER APPLY

Lumico offers Medicare Supplement Insurance is in the following states: AR., AZ., GA., IL., IN., KS., KY., LA., MI., MO., MS., NC., ND., NE., NV., OH., OK., OR., PA., SC., TN., TX., UT., VA., WI., & WV. for your convenience. "It’s important to compare Medigap policies since the costs can vary between policies for exactly the same coverage" Download your "Medicare & You" 2021 Guide book Copy Here: https://drive.google.com/file/d/1C_e0qCdrpXaJlKumlh5DzCMaostIqmXC/view?usp=sharing P.S. See page 73 about Medicare Supplements having the same exact coverage for varies prices. And see page 53 about Medicare not paying for Long Term Care Coverage.

|

Medicare does not cover dental and seniors are more susceptible to gum disease, root decay, dry mouth and oral infections. Typical cavities, root canals, other serious dental conditions.

|

|

All Non Health Related insurance Products Like Travel Insurance, Pet, Auto, Home, Business Insurance are below the Medicare Health Plans on this page. Above my state insurance Licenses. Thank you!

|

|

Recently, a beneficiary asked an Insurance Agent "Which plan is the best plan?" I answered "The best plan is the one that is best for you!" What do I mean by that? * Are your doctors in the plan network? * Are your prescription drugs on the plan Pharmacy Formulary list? * Would you rather pay a higher premium with little out of pocket money on services? * Would you rather pay a lower premium or $0 premium with higher co-pays, deductibles, and co-insurance? * Do you want to choose your own doctors or do you want to stay in a plan network? * Do you need new prescription glasses or a new hearing aid? * How much allowance does your plan give for hearing aids or eyeglasses? Will you be traveling in the next year? Will that be internationally or outside of your area where your doctors, hospitals and pharmacies are located? Will you be needing surgery in the next year? These are important things that you should consider before enrolling in a plan. You can also call 760-808-8098 #insurance #health #deductibles #prescription #medicare

Home, Auto, Motorcycle, Travel insurance: Click >>>> INCOME

Servicing Californians And Americans With The Best Health Plans! We are Licensed in twelve (12) states and we're contracted with multiple carriers to ensure that we give you the right coverage and rates available to meet your needs.My services and knowledge are at no additional charges to you whatsoever. Check the box for Certified Agent at the appropriate location near the end of the application and enter the following details where they require it: Kimmy Gerred 0L02007. Thank you! |

When you complete your application online at https://www.coveredca.com please fill in my name and license number as shown on the link or on my image on their required page so that I may be listed as your personal Certified Covered California agent in order that I can assist you on plan choices and options for when your preferred hospital and physicians are not shown as participating.

Click here for GEO Blue Travel International Health Insurance |

QualificationEffective DateAMERICAN GENERAL LIFE INSURANCE COMPANY

Accident & Health or Sickness02/21/2017

Life02/21/2017

AMERITAS LIFE INSURANCE CORP.

Accident & Health or Sickness02/27/2020

Life02/27/2020

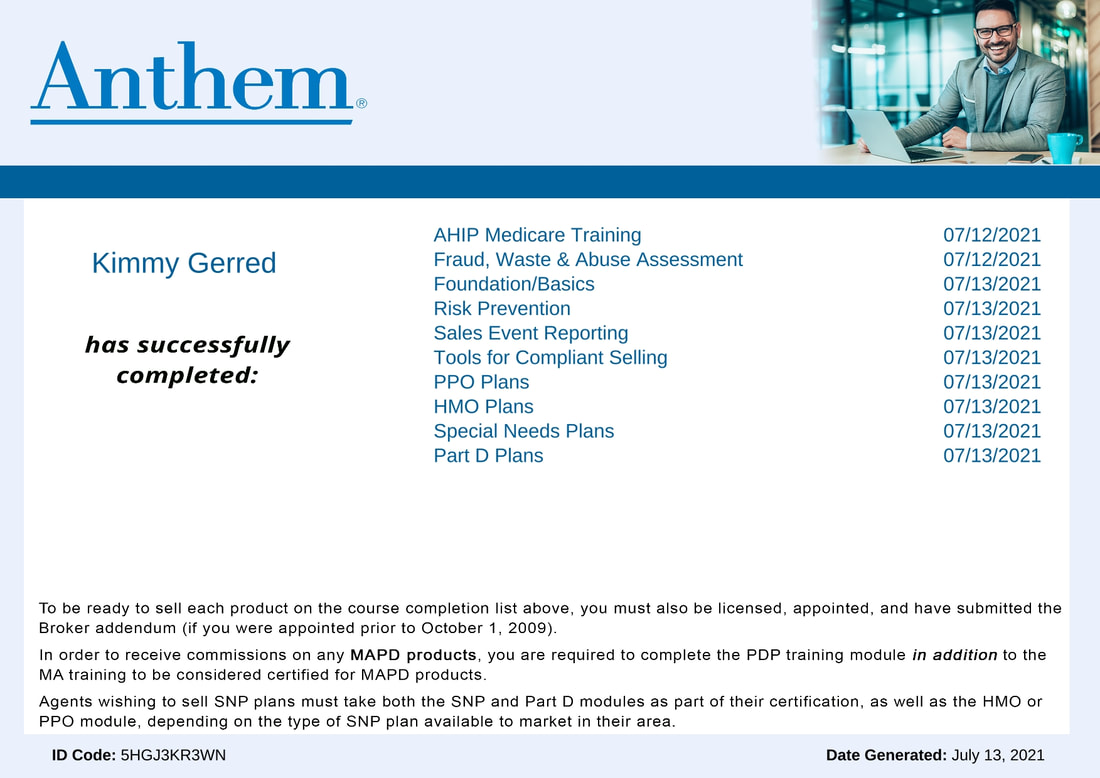

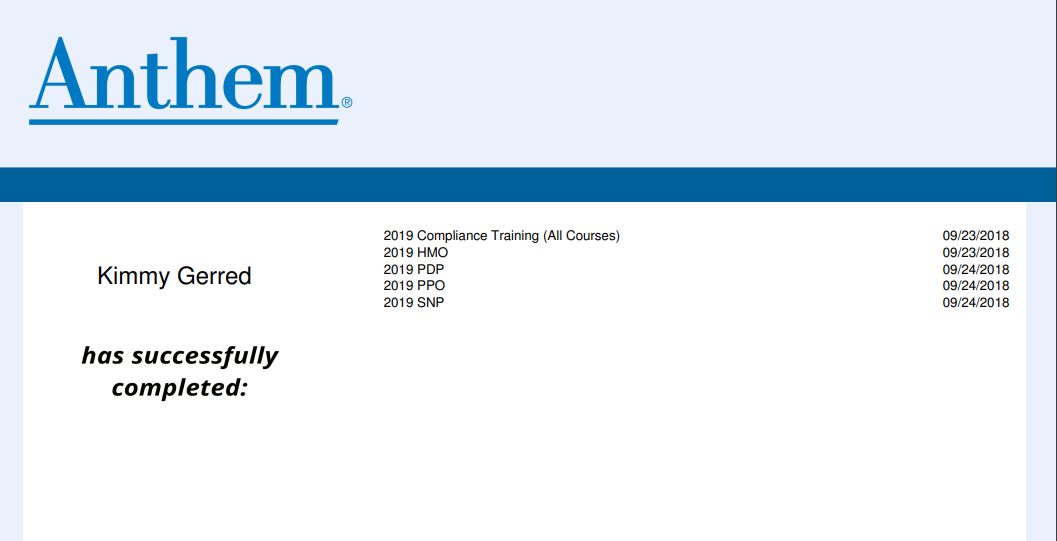

ANTHEM BLUE CROSS LIFE AND HEALTH INSURANCE COMPANY

Accident & Health or Sickness04/28/2018

Life04/28/2018

BANNER LIFE INSURANCE COMPANY

Life03/09/2017

BLUE SHIELD OF CALIFORNIA LIFE & HEALTH INSURANCE COMPANY

Accident & Health or Sickness03/21/2018

Life03/21/2018

CHESAPEAKE LIFE INSURANCE COMPANY (THE)

Accident & Health or Sickness02/02/2022

Agencies or Organizations

This licensee is authorized to transact on behalf of the following insurers:

Show 102550100All entries

Search:

QualificationEffective DateHEALTHCARE SOLUTIONS TEAM LLC

Life10/19/2020

CALIFORNIA HEALTH BENEFIT EXCHANGE

Accident & Health or Sickness12/14/2021

KIMMY GERRED INSURANCE SERVICES LLC

Life01/14/2022

HEALTHCARE SOLUTIONS TEAM LLC

Accident & Health or Sickness10/19/2020

KIMMY GERRED INSURANCE SERVICES LLC

Accident & Health or Sickness01/14/2022Name: GERRED KIMMY DARLENELicense #: 0L02007

License Type and/or QualificationOriginal Issue DateStatusStatus DateExpiration DateAccident & Health or Sickness07/27/2016Active07/27/201607/31/2022

Accident and Health07/27/2016Inactive05/20/202205/20/2022

Life07/27/2016Active07/27/201607/31/2022

Life-Only07/27/2016Inactive05/20/202205/20/2022

Business Address: 392 E. STEVENS RD. PALM SPRINGS CA, 92262

Business Phone: 760-250-6222

Language: EnglishCompany Appointments

This licensee is authorized to transact on behalf of the following insurers:

Show 102550100All entries

Search:

QualificationEffective DateCHESAPEAKE LIFE INSURANCE COMPANY (THE)

Life02/02/2022

CIGNA HEALTH AND LIFE INSURANCE COMPANY

Accident & Health or Sickness10/11/2019

FIDELITY & GUARANTY LIFE INSURANCE COMPANY

Life12/02/2021

GOLDEN RULE INSURANCE COMPANY

Accident & Health or Sickness10/29/2020

Life10/29/2020

HEALTH NET LIFE INSURANCE COMPANY

Accident & Health or Sickness11/20/2020

HUMANA INSURANCE COMPANY

Accident & Health or Sickness07/07/2021

Life07/07/2021

KAISER PERMANENTE INSURANCE COMPANY

Accident & Health or Sickness12/29/2020

NATIONAL HEALTH INSURANCE COMPANY

Accident & Health or Sickness11/17/2018Agencies or Organizations

QualificationEffective DateNATIONAL HEALTH INSURANCE COMPANY

Life11/17/2018

STANDARD LIFE AND ACCIDENT INSURANCE COMPANY

Accident & Health or Sickness09/03/2019

UNITED AMERICAN INSURANCE COMPANY

Accident & Health or Sickness12/07/2020

Life12/07/2020

UNITEDHEALTHCARE INSURANCE COMPANY

Accident & Health or Sickness02/07/2022

This licensee is authorized to transact on behalf of the following insurers:

Show 102550100All entries

Search:

QualificationEffective DateHEALTHCARE SOLUTIONS TEAM LLC

Life10/19/2020

CALIFORNIA HEALTH BENEFIT EXCHANGE

Accident & Health or Sickness12/14/2021

KIMMY GERRED INSURANCE SERVICES LLC

Life01/14/2022

HEALTHCARE SOLUTIONS TEAM LLC

Accident & Health or Sickness10/19/2020

KIMMY GERRED INSURANCE SERVICES LLC

Accident & Health or Sickness01/14/2022

Accident & Health or Sickness02/21/2017

Life02/21/2017

AMERITAS LIFE INSURANCE CORP.

Accident & Health or Sickness02/27/2020

Life02/27/2020

ANTHEM BLUE CROSS LIFE AND HEALTH INSURANCE COMPANY

Accident & Health or Sickness04/28/2018

Life04/28/2018

BANNER LIFE INSURANCE COMPANY

Life03/09/2017

BLUE SHIELD OF CALIFORNIA LIFE & HEALTH INSURANCE COMPANY

Accident & Health or Sickness03/21/2018

Life03/21/2018

CHESAPEAKE LIFE INSURANCE COMPANY (THE)

Accident & Health or Sickness02/02/2022

Agencies or Organizations

This licensee is authorized to transact on behalf of the following insurers:

Show 102550100All entries

Search:

QualificationEffective DateHEALTHCARE SOLUTIONS TEAM LLC

Life10/19/2020

CALIFORNIA HEALTH BENEFIT EXCHANGE

Accident & Health or Sickness12/14/2021

KIMMY GERRED INSURANCE SERVICES LLC

Life01/14/2022

HEALTHCARE SOLUTIONS TEAM LLC

Accident & Health or Sickness10/19/2020

KIMMY GERRED INSURANCE SERVICES LLC

Accident & Health or Sickness01/14/2022Name: GERRED KIMMY DARLENELicense #: 0L02007

License Type and/or QualificationOriginal Issue DateStatusStatus DateExpiration DateAccident & Health or Sickness07/27/2016Active07/27/201607/31/2022

Accident and Health07/27/2016Inactive05/20/202205/20/2022

Life07/27/2016Active07/27/201607/31/2022

Life-Only07/27/2016Inactive05/20/202205/20/2022

Business Address: 392 E. STEVENS RD. PALM SPRINGS CA, 92262

Business Phone: 760-250-6222

Language: EnglishCompany Appointments

This licensee is authorized to transact on behalf of the following insurers:

Show 102550100All entries

Search:

QualificationEffective DateCHESAPEAKE LIFE INSURANCE COMPANY (THE)

Life02/02/2022

CIGNA HEALTH AND LIFE INSURANCE COMPANY

Accident & Health or Sickness10/11/2019

FIDELITY & GUARANTY LIFE INSURANCE COMPANY

Life12/02/2021

GOLDEN RULE INSURANCE COMPANY

Accident & Health or Sickness10/29/2020

Life10/29/2020

HEALTH NET LIFE INSURANCE COMPANY

Accident & Health or Sickness11/20/2020

HUMANA INSURANCE COMPANY

Accident & Health or Sickness07/07/2021

Life07/07/2021

KAISER PERMANENTE INSURANCE COMPANY

Accident & Health or Sickness12/29/2020

NATIONAL HEALTH INSURANCE COMPANY

Accident & Health or Sickness11/17/2018Agencies or Organizations

QualificationEffective DateNATIONAL HEALTH INSURANCE COMPANY

Life11/17/2018

STANDARD LIFE AND ACCIDENT INSURANCE COMPANY

Accident & Health or Sickness09/03/2019

UNITED AMERICAN INSURANCE COMPANY

Accident & Health or Sickness12/07/2020

Life12/07/2020

UNITEDHEALTHCARE INSURANCE COMPANY

Accident & Health or Sickness02/07/2022

This licensee is authorized to transact on behalf of the following insurers:

Show 102550100All entries

Search:

QualificationEffective DateHEALTHCARE SOLUTIONS TEAM LLC

Life10/19/2020

CALIFORNIA HEALTH BENEFIT EXCHANGE

Accident & Health or Sickness12/14/2021

KIMMY GERRED INSURANCE SERVICES LLC

Life01/14/2022

HEALTHCARE SOLUTIONS TEAM LLC

Accident & Health or Sickness10/19/2020

KIMMY GERRED INSURANCE SERVICES LLC

Accident & Health or Sickness01/14/2022

Get A Quote Or Apply

For Under 65 Health Insurance, Dental, Vision & More Please Click Here: https://one.cards/wealthwavenow For Over 65 and Medicare Beneficiaries please see www.medicarehealthcareplan.com for Medicare Supplement Insurance and for Medicare Advantage Plans. Thank you!

Everyone needs Health Insurance! We have a Non Discrimination Policy and we want to see everyone have access to the very best Healthcare available in California & 8 Other states! Contact me now to apply!

All the Tools You Need to Succeed

We strive to get you the latest information and access to the best California Health Plans specializing in the desert region networks, and eight other states including Michigan, Ohio, Nevada, Mississippi, Florida, South Carolina, Tennessee, Washington & Life Insurance products for you and your family to enjoy your life with good health in a network that is convenient for everyone in your family.

This website is owned and maintained by Kimmy Darlene Gerred CA 0L02007, which is solely responsible for its content. This site is not maintained by or affiliated with Covered California, and Covered California bears no responsibility for its content. The e-mail addresses and telephone number that appears throughout this site belong to Kimmy Darlene Gerred CA 0L02007 and cannot be used to contact Covered California.

Not affiliated with or endorsed by the government or the federal Medicare program.

This website was last updated 03/04/2024

We do not offer all Medicare Health Plans in your area. To see all the plans in your area please go to www.medicare.gov. If you need help to make sure all your prescriptions and doctors are in network, call or text 760-250-6222 to speak to a licensed agent.

#Virginia #newmexico #Florida #Ohio #California #Michigan #Nevada #SouthCarolina #Texas #Oregon #Washington #health #life #insurance #medicare #rx #dental #vision #telemed #traumaTherapy #freeBooks #SubstanceUse

This website was last updated 03/04/2024

We do not offer all Medicare Health Plans in your area. To see all the plans in your area please go to www.medicare.gov. If you need help to make sure all your prescriptions and doctors are in network, call or text 760-250-6222 to speak to a licensed agent.

#Virginia #newmexico #Florida #Ohio #California #Michigan #Nevada #SouthCarolina #Texas #Oregon #Washington #health #life #insurance #medicare #rx #dental #vision #telemed #traumaTherapy #freeBooks #SubstanceUse

Click to set custom HTML